Considering contract opportunities can feel like stepping onto a new path, especially when those jobs are out of your home state. It's a different way of working, where the usual rules about paychecks and benefits might not quite apply. Figuring out how everything works, from your pay rate to what forms you get at tax time, becomes a really big part of the picture. So, it's almost like you are needing to think about things a bit differently than you might have before, you know?

Sometimes, these contract roles might even offer something like a W2, which is what regular employees get, but then say your pay would be "all inclusive." That can make you scratch your head a little, can't it? It suggests a pay arrangement where everything, from your hourly wage to any extra costs, is wrapped up into one lump sum. This kind of setup means you really need to look closely at what that means for you, especially when we talk about things like a 1099 form, which is a document for independent workers. Very, very important to get that straight, that is.

It can often feel like the people offering the contract have all the say in how things are set up. This is where getting a good handle on your situation becomes super important. You want to be sure you understand what you are signing up for, particularly when it touches on financial bits and pieces like what kind of tax paperwork you will receive. So, in some respects, gathering information and perhaps talking with others who have been in similar spots is a good idea, you know? It truly helps to be prepared.

- Fan Bus Leaks

- Yourfavmelons Onlyfans

- Erome Sophie Rain

- Sydney Sweeney Thefappening

- Camilla Araujo Nude Leaks

Table of Contents

- What's the Real Deal with Contract Work?

- Getting Your Head Around W2 and 1099 for Colorado Work

- Does Where You Work Matter for Your 1099 Form Colorado?

- Thinking About Different Places and Your 1099 Form Colorado

- How Do You Figure Out Your Money as a Contractor?

- The Money Side of Your 1099 Form Colorado

- Where Can You Get Good Advice on Your 1099 Form Colorado?

- Community Support for Your 1099 Form Colorado Questions

What's the Real Deal with Contract Work?

When you take on a contract job, especially one that takes you outside your home state, the way you are paid and how that affects your taxes can seem a bit different. Usually, there are two main ways people get paid for their efforts: as a regular employee or as an independent contractor. If you are a regular employee, your employer typically gives you a W2 form at the end of the year. This document shows your wages and all the money taken out for taxes, like income tax and Social Security. So, that's one common way things are done.

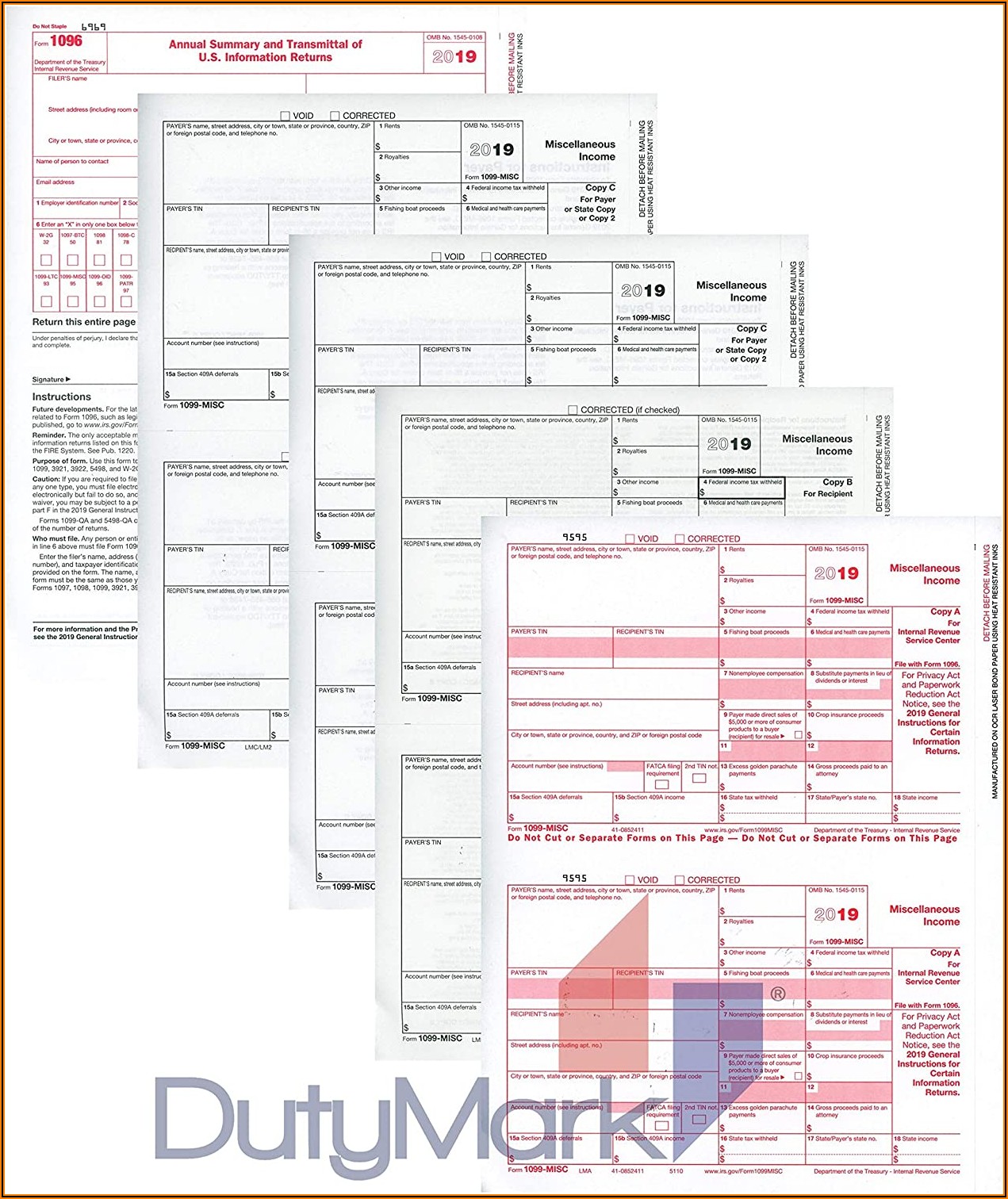

On the other hand, if you are an independent contractor, you are essentially your own boss for that particular job. The company hiring you usually sends you a 1099 form, often a 1099-NEC, if they have paid you more than a certain amount during the year. This form reports the total payments you received, but it does not show any taxes taken out. That is because, as a contractor, you are responsible for paying your own income taxes, self-employment taxes, and any other required contributions. It means you have a bit more to handle on your own, you know? This is a key difference to keep in mind, particularly when you are looking at opportunities that might involve a 1099 form Colorado.

Sometimes, a contract offer might seem to mix these two ideas. The original text mentions being offered a W2, but with an "all inclusive" rate. This phrasing can be a little confusing. A W2 usually means you are an employee, and the company handles things like withholding taxes and benefits. An "all inclusive" rate, however, often sounds more like something a contractor would get, where their pay covers everything, and they handle their own expenses and tax obligations. It is like trying to put two different puzzle pieces together, which can be pretty tricky. So, you might need to ask for more clarity on what exactly that means for your status and responsibilities, actually.

Getting Your Head Around W2 and 1099 for Colorado Work

When you are looking at contract jobs, especially those that might involve a 1099 form, understanding the fine points of your work arrangement is really important. If a company says they will give you a W2 but your rate is "all inclusive," it might mean they are trying to classify you as an employee for some purposes but pass on certain costs or responsibilities that typically fall to a contractor. This could affect things like who pays for your work-related expenses, whether you get benefits, and how your taxes are handled. It is a bit of a gray area, perhaps, and something to really think about.

For someone considering contract work, especially if it leads to a 1099 form, the biggest shift is often the tax side of things. With a W2, your employer takes care of a good chunk of the tax calculations and payments. With a 1099, that job falls squarely on your shoulders. This means setting aside money for taxes throughout the year, usually through estimated tax payments. It also means keeping very good records of your income and any business expenses you might have. So, in a way, you become your own finance department, which is quite a big step.

The state where you live and the state where the work happens can also add layers to this. If you are in Colorado and taking on contract jobs out of state, or if you are outside Colorado but doing work for a company based there, the rules for how your income is taxed can vary. Different states have different income tax rates, and some states do not have income tax at all. This means that a 1099 form Colorado might look a bit different from a 1099 form in, say, Texas or Florida, when it comes to state-level tax considerations. It is a good idea to look into these details, naturally, to make sure you are prepared for what is ahead.

Does Where You Work Matter for Your 1099 Form Colorado?

The location of your contract work, and where you live, can definitely play a part in how you deal with your 1099 form. If you are taking contract jobs that are "out of my state," as mentioned in the original text, you are entering the world of multi-state tax situations. This means you might owe taxes in more than one state, or at least need to file tax returns in different places. For someone living in Colorado, working for a company in another state, or vice versa, understanding these rules is really quite important. So, it's not just about the federal government; states have their own rules too.

Thinking about different places, like Phoenix, Arizona, or the Seminola neighborhood in Hialeah, Florida, as mentioned in the provided text, shows how varied locations can be. Each place has its own cost of living, local income levels, and even specific local conditions. For a contractor, these details can influence how much you need to charge for your services to maintain your desired lifestyle, or how much of your income you can actually keep after expenses. It is like looking at a map and seeing all the different colors, each representing a slightly different set of circumstances, you know? This can be pretty interesting to consider.

The original text also lists various neighborhoods and cities, like West Montgomery, Alabama; North Memphis, Tennessee; Atlanta, Georgia; and even gives median household income figures for places like Greenville, South Carolina, and Joplin, Missouri. These details, while not directly about Colorado, highlight the kind of information someone might look at when considering where to take contract work. A higher median income in a certain area might suggest more opportunities or higher rates, while a lower one might mean a lower cost of living, which could make an "all inclusive" rate go further. So, you might be thinking about these kinds of numbers, too.

Thinking About Different Places and Your 1099 Form Colorado

When you are an independent contractor, the financial landscape can shift quite a bit depending on where you are located or where your clients are. For instance, if you are handling a 1099 form Colorado, but your main client is in, say, Spokane, Washington, or Orlando, Florida, you need to consider how each state's tax system might affect your overall earnings. Some states have higher income taxes, others have none, and this can make a real difference to your take-home pay. It is almost like each state has its own set of financial weather patterns, and you need to be ready for them.

Even things that seem unrelated, like the mention of radon zones in Tennessee, can, in a very broad sense, point to the idea that different locations have different environmental or living conditions that might influence a contractor's decision to work or live there. While radon levels might not directly affect your 1099 form Colorado, they are part of the bigger picture of what it is like to live and work in a particular area. A contractor might consider all sorts of factors, from local housing prices in places like South Boise Village, Idaho, or the Waldo neighborhood in Kansas City, Missouri, to general quality of life, when deciding on a contract. So, these seemingly small details can add up, basically.

The median household income figures provided for places like Greenville, SC, and Joplin, MO, offer a glimpse into the economic situations of different areas. For a contractor, understanding the local economy can be helpful. If you are considering moving for a contract job, or if you are working remotely for clients in different economic environments, knowing these figures can help you gauge what a fair "all inclusive" rate might be. It is about getting a sense of the economic pulse of a place. You know, like, what is the typical earning power there? This helps you figure out if your rate is competitive and sustainable, which is pretty important.

How Do You Figure Out Your Money as a Contractor?

When you are a contractor, especially with an "all inclusive" rate, figuring out your money is a bit different from being a regular employee. With a W2 job, your employer takes out taxes, pays their share of Social Security and Medicare, and often contributes to benefits like health insurance or retirement plans. Your paycheck is what you get after all that. But with an "all inclusive" rate, particularly if it means you will receive a 1099 form, you are responsible for a lot more of those costs yourself. So, it's like you are running a little business, in a way.

This means that your "all inclusive" rate needs to cover not just your time and skill, but also things like your self-employment taxes, any health insurance premiums, retirement savings, and even business expenses like a home office, equipment, or travel. If you are working out of state, as the original text suggests, your travel costs could be quite substantial. You might need to factor in lodging, food, and transportation. All these things come out of that "all inclusive" payment. It is a bit like making sure your basket is big enough to hold all the groceries you need, and then some, you know?

Understanding what you can deduct as a business expense is also a big part of managing your money as a contractor. The tax rules allow independent contractors to deduct many costs related to their work, which can help lower their taxable income. This is a key difference from a W2 employee, who typically cannot deduct work-related expenses unless they itemize and meet certain thresholds. So, for someone dealing with a 1099 form Colorado, keeping careful records of every expense is absolutely essential. It can make a significant difference to how much tax you end up paying, honestly.

The Money Side of Your 1099 Form Colorado

The financial side of receiving a 1099 form, especially if you are based in Colorado, means you are effectively running your own small enterprise. This involves budgeting for taxes, which are not withheld from your payments. You will typically need to make estimated tax payments throughout the year to cover your federal income tax and self-employment taxes. This is a pretty important step to avoid a big tax bill or penalties at the end of the year. So, you need to be thinking ahead about this, really.

When your rate is "all inclusive," it is important to remember that this covers everything. It means the client is not paying for your health insurance, your paid time off, or your retirement contributions. You need to build the cost of these things into your rate. For example, if you were an employee, your company might pay half of your Social Security and Medicare taxes. As a contractor, you pay both halves yourself. This is often referred to as self-employment tax. It is a bit of a jump from what many people are used to, you know?

Considering the various geographical locations mentioned in the original text, like Atlanta, Georgia, or the different neighborhoods with their detailed profiles, can help put the "all inclusive" rate into perspective. If the cost of living in one of these areas is very high, your "all inclusive" rate might need to be higher to give you the same quality of life as a lower rate in a less expensive area. It is about understanding the purchasing power of your money in different places. So, a rate that seems good in one spot might be just okay in another, or even not enough. You have to do your homework, basically.

Where Can You Get Good Advice on Your 1099 Form Colorado?

Finding good information and support is really helpful when you are dealing with contract work and things like a 1099 form. The original text mentions a "very popular forum" where you can register to post and access all features. This kind of online community can be a fantastic place to ask questions, share experiences, and learn from others who are also working as independent contractors. So, connecting with people who understand what you are going through can make a big difference, you know?

Forums like the one described, where "Over $68,000 in prizes has already been given out to active posters," suggest a lively and engaged community. This kind of interaction can be incredibly valuable for getting practical tips on everything from setting your rates to understanding specific tax situations, even if it is general advice rather than professional tax counsel. You might find people discussing how they handle out-of-state contract jobs, or what they include in their "all inclusive" rates. It is like having a group of friendly advisors at your fingertips, which is pretty neat.

While forums offer peer support, it is also smart to seek advice from professionals for specific questions about your 1099 form Colorado or multi-state tax situations. A qualified tax advisor who understands the rules for independent contractors can help you figure out your deductions, estimated taxes, and any state-specific requirements. They can help you make sure you are doing everything correctly and avoiding any surprises down the line. So, think of it as getting the best of both worlds: community wisdom and expert guidance, which is very helpful.

Community Support for Your 1099 Form Colorado Questions

Being an independent contractor can sometimes feel a bit solitary, especially when you are trying to sort out tax forms like the 1099. That is why online communities and forums, like the one mentioned, can be such a good resource. They provide a place where people can swap stories, ask those "dumb questions" that are actually very smart, and get a sense of belonging. It is like having a water cooler chat, but with people from all over who are dealing with similar work situations. So, you are not alone in this, basically.

When you are pondering the implications of an "all inclusive" rate or how your contract jobs out of state might affect your 1099 form Colorado, hearing how others have managed similar situations can provide comfort and practical ideas. Someone might share their system for tracking expenses, or how they approach negotiations for their rates. These real-world examples can be incredibly useful, helping you feel more confident about your own choices. You know, like, seeing how someone else solved a puzzle can help you solve yours, too.

Even though the original text jumps from job offers to forum details and then to various city profiles and income data, the underlying message is about gathering information and making informed choices. Whether it is about understanding the nuances of your pay structure, considering the financial implications of different locations, or finding support, having access to diverse information sources is key. These communities and data points, in their own way, help paint a fuller picture for anyone stepping into the world of contract work. So, it is all about getting the full story, more or less.

This discussion has covered the nature of contract work and the 1099 form, especially when considering jobs out of your state. We looked at the difference between W2 and 1099, and what an "all inclusive" rate might mean for your finances. We also explored how geographical locations and their economic details could play a part in your decisions as a contractor, using examples from various cities and neighborhoods. Finally, we touched on the value of community forums and professional

Related Resources:

Detail Author:

- Name : Jazmyn Lehner

- Username : maddison41

- Email : oschmeler@kreiger.com

- Birthdate : 1976-09-10

- Address : 32074 Arno Fork Elmiraport, VT 65588

- Phone : 551-725-3196

- Company : Kuhic-Powlowski

- Job : Mechanical Engineering Technician

- Bio : Quaerat tenetur est nobis maxime voluptatem. Nobis sit delectus minus ea labore sint sit inventore. Maxime voluptas quis suscipit recusandae et non. Qui hic quisquam quae debitis voluptas.

Socials

tiktok:

- url : https://tiktok.com/@cblick

- username : cblick

- bio : Aut eum id debitis neque placeat.

- followers : 492

- following : 1470

instagram:

- url : https://instagram.com/celestine3698

- username : celestine3698

- bio : Aliquid et odit fugit veniam dolore voluptas magni laboriosam. Aliquam quia ea aut dignissimos.

- followers : 995

- following : 19

twitter:

- url : https://twitter.com/celestine_blick

- username : celestine_blick

- bio : Consequuntur inventore ipsa hic voluptate. Et consequatur harum velit et. Necessitatibus repellat minus odio dolorum dolores.

- followers : 170

- following : 2522