Getting a tax form in the mail can sometimes feel like a puzzle, especially when it is something you might not see every single year. The Form 1099-G, specifically, shows payments you have received from a government entity. This can include things like unemployment compensation, state or local income tax refunds, or even certain agricultural payments. For folks living in or moving to the Centennial State, knowing about your 1099-G Colorado details is pretty important, as it helps you figure out your taxes correctly and avoids any surprises later on.

This little piece of paper, you see, tells the IRS and you about money that came your way from state or local government sources. It is not always about unemployment, though that is what many people first think of when they hear about it. For someone considering contract jobs, say, out of their home state, where they are offered an all-inclusive rate instead of a W2, keeping track of these forms from different places becomes quite a big deal. It is, in a way, about making sure all your income, no matter where it comes from, gets reported the right way.

So, whether you have been living in Colorado for ages, or you are thinking about making a move from somewhere like Phoenix, Arizona, or perhaps even a place like Joplin, Missouri, to a new opportunity, knowing what to do with a 1099-G from Colorado, or any other state for that matter, truly matters. It helps you stay on top of your financial picture and ensures you are ready when tax time rolls around. We will go through some of the ins and outs of this form, giving you a clearer picture of what it means for you.

Table of Contents

- What Is a 1099-G and Why Do I Get One?

- How Does 1099-G Colorado Relate to Unemployment Benefits?

- What If My 1099-G Colorado Shows a State Tax Refund?

- What to Do With Your 1099-G Colorado Information

- What If I Moved From Another State to Colorado?

- Common Questions About Your 1099-G Colorado

- Getting Help With Your 1099-G Colorado

- A Quick Look Back

What Is a 1099-G and Why Do I Get One?

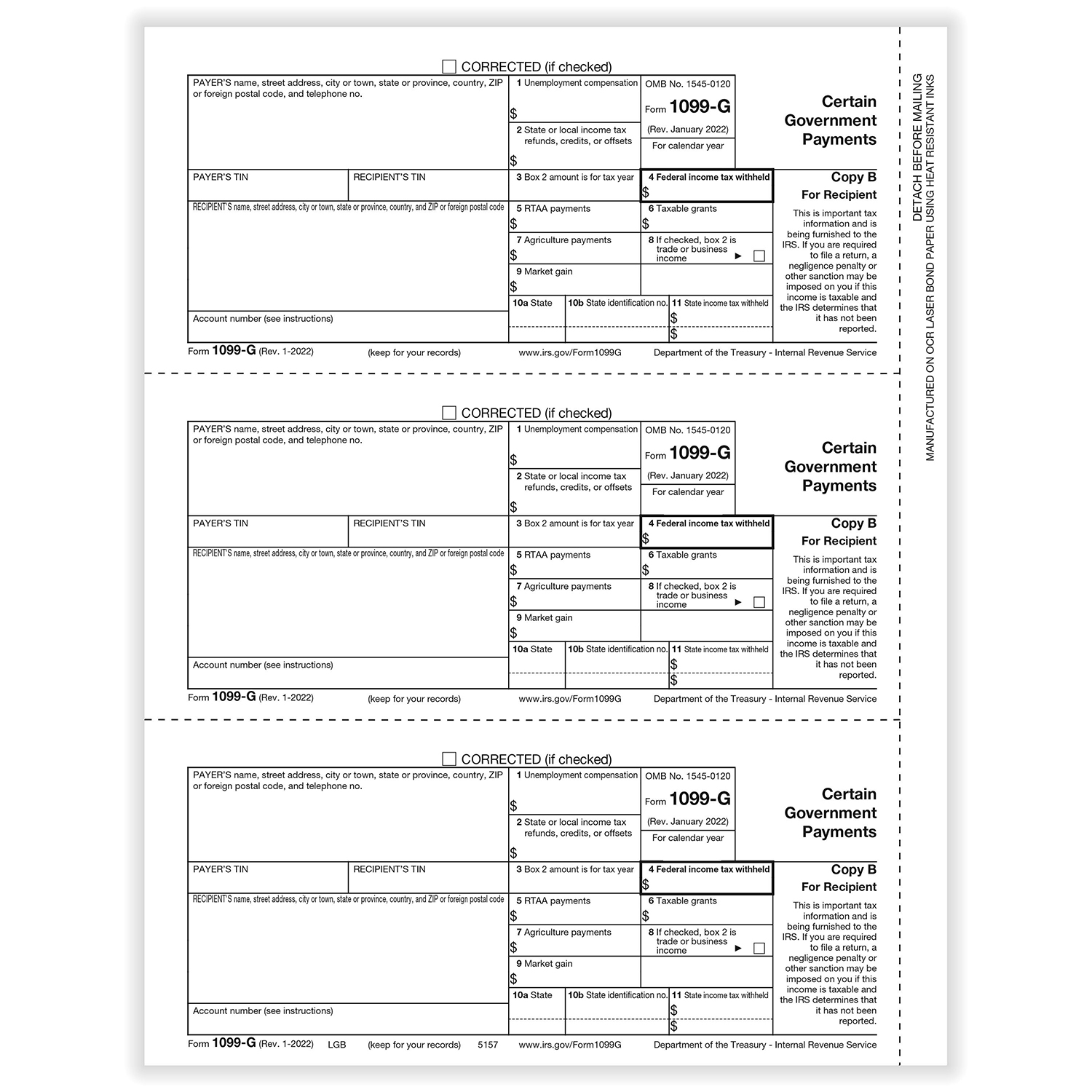

A Form 1099-G, sometimes called a "Certain Government Payments" form, is a document the government sends out to tell you and the IRS about money it has paid to you. It is pretty much like a report card for government income. You might get one for a few different reasons, actually. The most common one people hear about is unemployment compensation. If you were out of work for a bit and got payments to help you out, those payments show up on this form. It is also used for things like state or local income tax refunds, if you itemized deductions in a past year and then got some money back. So, in a way, it is the government's way of saying, "Hey, we paid you this much, and it is income."

Other, less common reasons to receive a 1099-G could involve certain taxable grants or agricultural payments, but those are not as frequent for most folks. The key idea here is that if a government body, whether state or local, gave you money that is considered taxable, they will send you this paper. It is just a record, you know, to keep everything clear for tax time. This is really important for anyone who might be doing contract work, especially if their rate is all-inclusive, meaning they are responsible for their own tax obligations, unlike someone who gets a W2. Knowing about every bit of income, even from the government, helps make sure you are ready for tax season.

How Does 1099-G Colorado Relate to Unemployment Benefits?

For many individuals, the 1099-G is directly tied to unemployment benefits. If you lived and worked in Colorado, and then, unfortunately, found yourself without a job and received payments from the state's unemployment division, those amounts will be on your 1099-G Colorado form. The state is required to report these payments to the IRS, and to you, because unemployment compensation is considered taxable income by the federal government. This means you need to include it when you figure out your federal income taxes. It is, quite simply, money you received that counts as income.

It is worth noting that even if you had state taxes taken out of your unemployment payments, you still need to report the gross amount on your federal return. The amount of taxes withheld will also be listed on your 1099-G Colorado, and you will use that figure when you do your taxes. This is why getting the correct form is so vital. If you were, for example, thinking about taking on a contract job in a place like Atlanta, Georgia, after being laid off in Colorado, any unemployment money you got from Colorado before you started that new gig would be on this form. It is just part of your overall income picture for the year.

What If My 1099-G Colorado Shows a State Tax Refund?

Another common reason to get a 1099-G Colorado is if you received a state or local income tax refund. This is a bit different from unemployment. You only need to report this refund as income on your federal tax return if you itemized your deductions in the year you paid those taxes. Basically, if you took the standard deduction, your state tax refund is not considered taxable income by the federal government. So, it is kind of a "sometimes taxable" situation, which can be a little confusing.

The reasoning behind this is that if you itemized, you likely deducted the state taxes you paid. When you then get a refund of those taxes, the IRS sees it as getting back a deduction you already claimed, so they want to tax it. It is a way of balancing things out. If you lived in a place like North Memphis, Tennessee, and moved to Colorado, and then got a refund from Tennessee's state taxes (if applicable), that would show up on a 1099-G from Tennessee, not Colorado. But the principle is the same. It is something to pay attention to when you are gathering all your tax papers.

What to Do With Your 1099-G Colorado Information

Once you get your 1099-G Colorado form, the most important thing to do is keep it with your other tax documents. It is a piece of information you will need when you prepare your federal income tax return. Whether you do your taxes yourself using software, or you have a tax preparer help you out, this form is a must-have. You will enter the amounts from the 1099-G into the appropriate sections of your tax form, typically on Schedule 1 (Additional Income and Adjustments to Income) of Form 1040.

If you use tax software, it will usually guide you through where to put the numbers from your 1099-G. Just make sure you are entering the figures in the right spots, like the gross amount of unemployment compensation and any federal income tax withheld. It is, you know, just about making sure all the numbers match up. For someone who is, say, exploring contract jobs where they are responsible for their own taxes, unlike a W2 employee, being extra careful with every income source, including government payments, is just good practice. It helps prevent any issues with the tax folks down the road.

What If I Moved From Another State to Colorado?

Moving between states, especially for new job opportunities, can make tax season a bit more interesting. If you were living in, say, West Montgomery, Alabama, or even South Boise Village, Idaho, and received unemployment benefits from that state before moving to Colorado for a contract job, you would get a 1099-G from your *old* state, not Colorado. This is a common scenario for people who relocate. You would still need to report that income on your federal return, even though you are now a Colorado resident.

The important thing here is to remember that the 1099-G comes from the government agency that *paid* you the money, not necessarily from where you live now. So, if you were getting unemployment from, say, Florida, while living in the Seminola neighborhood of Hialeah, and then moved to Colorado, your 1099-G would come from Florida. It is, basically, about where the money originated. This can sometimes lead to people missing a form because they expect it from their new state. Always keep an eye out for mail from your previous state's unemployment or tax department if you received benefits or a refund there.

Common Questions About Your 1099-G Colorado

People often have questions about their 1099-G Colorado form, and that is completely normal. One common query is, "What if I did not get my 1099-G?" If you were expecting one, especially for unemployment benefits, and it has not arrived, you should reach out to the Colorado Department of Labor and Employment. They are the ones who issue these forms. They usually have an online portal where you can access your form digitally, which can be very handy. It is, you know, just like accessing details about forum prizes online, but for tax forms.

Another question might be, "What if the amount on my 1099-G Colorado seems wrong?" If you think there is an error, you will also need to contact the issuing agency directly. Do not just guess or change the amount yourself. They can review your records and issue a corrected form if needed. It is always best to get the official corrected document. For those who are dealing with contract jobs and their own tax responsibilities, getting these details right is really a big deal for accuracy.

Getting Help With Your 1099-G Colorado

Sometimes, figuring out your taxes, especially with forms like the 1099-G Colorado, can feel a bit much. If you are unsure about what to do with your form, or how it affects your overall tax picture, it is always a good idea to seek help. A qualified tax professional, like a certified public accountant (CPA) or an enrolled agent, can provide guidance. They are, you know, the experts who deal with these kinds of things all the time.

There are also free tax help resources available, such as the IRS's Volunteer Income Tax Assistance (VITA) program or Tax Counseling for the Elderly (TCE). These programs offer free tax preparation for eligible individuals, and they can certainly help you with your 1099-G. It is just about finding the right support when you need it. For someone who is moving between states, perhaps from a place with a different economic situation, like Joplin, Missouri, where the median household income is quite a bit less than in some other areas, getting good tax advice can make a real difference.

A Quick Look Back

This article has covered the basics of the 1099-G form, especially as it relates to Colorado. We talked about what a 1099-G is and the main reasons you might receive one, such as for unemployment benefits or state tax refunds. We also went over what you need to do with the information on your 1099-G Colorado when it is time to prepare your taxes. Plus, we touched on how receiving this form can be a bit different if you have moved from another state to Colorado for work, like a contract job. We also answered some common questions about the form and mentioned where you can get help if you need it. It is all about making sure you understand this particular piece of paper so you can handle your taxes with confidence.

Related Resources:

Detail Author:

- Name : Leland Tromp

- Username : enoch59

- Email : brandyn97@homenick.com

- Birthdate : 1975-05-16

- Address : 8745 Elta Expressway Apt. 218 Goldnerfurt, AK 41584-3821

- Phone : 352.842.8952

- Company : Trantow, Jacobi and Hickle

- Job : Electronic Drafter

- Bio : Dolorum optio quisquam vel. Debitis ex aut ullam explicabo. Officia accusantium adipisci assumenda ad quasi maiores.

Socials

linkedin:

- url : https://linkedin.com/in/acarter

- username : acarter

- bio : Amet ab animi quia nostrum at.

- followers : 4011

- following : 1802

facebook:

- url : https://facebook.com/adelia4354

- username : adelia4354

- bio : Dignissimos quas laudantium praesentium commodi quisquam.

- followers : 6292

- following : 2537

instagram:

- url : https://instagram.com/adelia717

- username : adelia717

- bio : Sit ullam qui praesentium quas. Ut molestiae et debitis totam ipsa.

- followers : 3349

- following : 2448

twitter:

- url : https://twitter.com/cartera

- username : cartera

- bio : Possimus et corrupti optio non dicta. Itaque voluptas aperiam consequuntur nostrum. Ab sint voluptate ab dolorem at.

- followers : 3210

- following : 1279